eISSN: 2576-4470

Research Article Volume 3 Issue 4

1Head of Business Department Sindh University Larkana Campus &PhD. Scholar, Shah Abdul Latif University, Pakistan

2Institute of Business Administration (IBA), University of Sindh, Pakistan

3Department of Business Administration, Sindh University Campus Larkana, Pakistan

5Department of Nursing and Community Health Services, Shaheed Muhtarma Benazir Bhutto Medical University, Pakistan

Correspondence: Ghulam Mustafa Shaikh, Assistant Professor, Head of Business Department Sindh University Larkana Campus & PhD. Scholar, Shah Abdul Latif University, Khairpur, Pakistan, Tel +92-332-2773262

Received: July 08, 2019 | Published: July 22, 2019

Citation: Shaikh GM, Katpar NK, Panhwar GA, et al. Do behavioral biases in gender differences affect investment decisions? Sociol Int J. 2019;3(4):326-336. DOI: 10.15406/sij.2019.03.00194

The purpose of this study is to investigate that whether the gender can affect the investment decision making by considering the effect of two behavioral biases i.e. risk aversion and over confidence? This study is conducted on Investors of National Saving Center (NSC), residents of Karachi, Hyderabad and Sukkur Regions. The questionnaire based survey was used as a tool to collect the data using convenient sampling technique. The sample size consisted of 391 investors comprising of 217 male and 174 female. The Chi- square test was used to analyze the data and to find out the significant association of the gender differences of the investors in the context of risk aversion and overconfidence biases. The findings of this study regarding the risk aversion show that, when compared with male, the female are more conservative in making the financial decisions while male are more risk takers than female. The results of gender differences based on overconfidence are seems to be mixed. The one conclusion can’t be drawn on the basis of the results found from the questions of overconfidence and no any significant association was found between gender and overconfidence. This study also found that besides the gender differences in risk aversion and overconfidence, fewer investors prefer to invest in the financial market.

Keywords: gender differences, behavioral biases, decision making

Decision making is an art to tackle the complex situations in an effective and efficient manner. It was empirically examined by (Chen) that decision making process is influenced by endogenous as well as exogenous factors. Precisely, individual characteristics and systematic factors are the important elements that have noteworthy influence on the investor’s financial decisions making. To evaluate individuals‟ ability to make decision can be dependent on the financial literacy, confidence and managing the individuals‟ finances. According to (Piyatrapoom) determinants such as economic, social, political etc can serve as important criteria for making the decisions regarding investment. Over the years it is seen that the return of the aggregate stock market and individual behavior in investment decision making is not easily understood by the traditional finance models. This had led to the emergence of the behavioral finance to overcome these difficulties in current financial scenario.1 The field of behavioral finance seeks to make the better understanding and explaining the biases related to emotions and cognitions to influence the investor’s decision making process.2 According to, behavioral finance is related with how the humans understand or interpret the information and based on that information how they act to make informed decisions regarding investment. Behavioral finance analyzes the influences of psychological variances in financial decisions and its consequent outcome on markets. When rational models do not provide enough clarification, behavioral finance provide adequate reasoning for such irregularities in the investor’s decision making or behavior.

Behavioral finance has attempted to explain and make better understanding about how the biases related to emotions and cognitions affect the individual investors and the processes of investment decision making.2 This field relates the psychology with the finance. To provide comprehensive elaboration, this field is categorized into Behavioral Finance Macro (dealing with stock market anomalies) and Behavioral Finance Micro (dealing with individual investor biases).

Behavioral biases

Bias is an inclination to make such decisions that are affected by some underlying beliefs. Behavioral Finance provides a good understanding of the economic decisions and tells the phenomena that how these decisions influence the prices and return in the market, and how the resource allocation is done. This field bases the research on the human behavior involving the social, cognitive and emotional biases. Behavioral finance hunts that due to which reason the investors make decisions based on emotions rather than the fundamentals of investment.3 There are a number of behavioral and psychological biases that affect the investment decision making and restricts the rationality to evaluate the alternatives based on fundamentals of investment. There are various biases that the investors as humans display, like: Disposition Effect, Availability Bias, Representativeness Bias, Confirmation Bias Excessive optimism, Illusion of control, Sunk cost, familiarity heuristic,3 Overconfidence bias and Risk aversion.4 These biases are related to many types but most of the two types which are more prominent and which this study is going to focus on are Over confidence and Risk Aversion.

Over confidence

Over confidence is basically the overestimate to create the value. By being over confident one person who makes mistakes but at that time one can forget that and then start overestimating. Chernoff5 defined those overconfident individuals by asserting that “Too many people who over value that they are not and under value that what they are”. Self-attribution is a habit and according to this one can get the tribute of success while employing the guilt of failure on the other external parties and such people have a slogan like “Heads I win, tails its chance”.6 Over confident individuals often misunderstand their own knowledge and do not give attention to others and that‟s why there is the chance of getting lower return.7 Over confident individuals feel that they are more competent and they have more skills than others. Over confident people are optimistic and they quickly complete their task. Overconfidence is basically derived from the self-attribution biases.

Risk aversion

Risk and uncertainty both terminologies are related to decision making processes. Risk is always the part of life examined that risk comprises of two components: one is the probability of negative outcomes and the other is the negative event that has taken place. Walker defined the uncertainty as the decision making that is based on the partial knowledge. Risk aversion means investors prefer to avoid the risk and they try to invest in less risky assets where they get more return. Risk aversion is most important and basic assumption of economic behavior while it is also most important factor of human behavior. Risk averse investor stays away from the risky assets and dislikes the risk because he/she always look for the lower risk and higher return.

Gender differences in Biases

From the history the men have been considered on superior status then the women. Man has always enjoyed many advantages in terms of economic resources, political powers, rationality and physical strength. The man has been associated with the power. The woman has to surrender their family’s names after marriage. In short the men are culturally given the more value than the women. The gender differences exist in making every perception for any decision.8 The differences in the gender have been more focused on the biological factors in the past researches. The men and women are different from each other psychologically. The exiting gender differences are also being under research in the biases. The gender differences exist in the biases like Heuristics.9

Gender differences in risk aversion and overconfidence

Everyday individual deals with the difference of the choices and make decision over these choices. There is usually the uncertainty involved in the common situations which lead to the somewhat the risk when making the decisions. Sometimes the risk is unavoidable. The individual characteristics and preferences may lead to accept the more or less risk. The acceptance of the risk is influence by the one factor that is gender. Men and women differ in many levels and areas in this way there are differences in the risk level they accept.10 The other situation that investors usually involve is the over confidence. The overconfidence is the biases in which the individuals have much in their cognition, intuition and decision making. The individuals involved in the over confidence misinterpret their knowledge, they involve in the excessive trading which may lead to the lower returns.7 The gender is found to be the much stronger predictor of the level of the over confidence and the risk aversion level of the investors.11

The purpose of the study or statement of the problem

In this technological era, the involvement of men and women is approximately equal and provides an equal access to investment in financial instruments. However, such investment decisions might be hampered by some behavioral factors like: Risk aversion and Over confidence that might have a relation with gender. Therefore, the main purpose of this study is to analyze the gender differences in biases (i.e. risk aversion and overconfidence) in investment decision making. This study can help the Government, Bankers or finance professionals to formulate policy or financial products or instruments accordingly and to understand the gender differences related to behavioral biases, so that they can overcome those biases based on the gender (if any).

Research questions

Objectives

Bias: The term is defined as act to support or reject a particular person, opinion or thing in an unjust way because of including the personal beliefs or opinions in the judgment process.12 Risk: The term is defined as the chance that the actual and expected investment return could be different.13

Risk aversion: This term defines the reluctance of a person that accepts the lower return with lower uncertainty by avoiding the higher uncertain returns or alternatives.14 Overconfidence effect: This term refers to the investor‟s cognitive bias in which he is inclined to believe that his judgments are better or more reliable than others.

There is a strong contradiction in the conventional finance and behavioral finance. The conventional finance assumes that the investor make rational decision making, in contrast the behavioral finance questions this and described that the investor show their behavior due to certain factor which is in accordance with the modern portfolio theory. The behavioral finance shows that the behavior of the investor is based on the certain physiological variables such as fear and greed for anything. The change in the degree of the effects of these variables leads to certain behavioral biases which are the concern of the researches today. The behavioral biases have shown the effects on the financial decision making in the previous studies.15 The study of15 argued that Gender is one of the demographics which has a protruding effect over behavior biases like overconfidence and risk aversion.

Overconfidence Bias

Based on the various cognitive psychological researches overconfidence has been described as the over estimation of ones own abilities in different areas or contexts.16 When peoples subjective and objective probabilities of their judgment are not matched with each other, it is most likely to result in the poor calibration which is the over or the under confidence.17

Risk aversion

To define the risk aversion, utility theory provides some support to this conceptualization. This theory is based on the diminishing marginal utility of the wealth. It proposes that a single dollar bill has more importance to the poor as compared to the rich one, which shows that why people having less wealth are willing to take more risk as compared to the wealthy individuals. Moreover, when the expected utility is high, the individuals tend to choose the risky alternatives.15According to Portfolio selection theory, as given by the Markowitz in 1952, investor look for the efficient portfolios which is based on their ability and willingness to assume risk. When they choose among different asset classes they show the risk aversion and income maximizes, which means that the individual tends to accept less risk for a certain level of the return. With respect to the modern portfolio theory, the portfolio should be much balanced for the risk adverse investor. The risk can be minimized with the diversification. However, the diversification doesn’t work for the total risk but it reduces the systematic risk up to some extent.

Outcomes of previous research studies: According to18 in article-“Overconfidence and Loss Aversion in Investment Decisions: A Study of the impact of Gender and Age, in Pakistan”. The demographic variable of gender had a noticeable impact on biases like overconfidence and loss aversion. The outcomes of research conclude that in Pakistan, men have a higher degree of overconfidence whereas women are higher at loss averse degree. The study further elaborated that people who choose more risk are usually more overconfident. Questionnaire based survey method was used. The analysis methods used in this study were Chi-square, OLS and correlation analysis4 in their study found that the Male are more tending to take the risk and choose to spend in assets that have high uncertainty as compared to women who choose risk free investments. While the overconfidence effect was not ascertained based on the gender due to the mixed results in study. A close ended questionnaire was used to obtain the data while the results were measured using the chi-square test. After analyzing the variables like: sex, age, knowledge, risk tolerance and wealth allocation, the study of showed that women seems to be more risk averse and put their money in assets that have low risk in comparison to men because they perceive that they have less investment knowledge. Based on the convenience sampling a graphic-based survey instrument by Hanna was used to collect the data from Nepalese banking sector employees under this study. The study conducted by11 divided the respondents in two groups based on their knowledge. For both high and low knowledge groups, the study found that men were significantly more confident than women. The study further indicated the following results:

To test the gender differences based on overconfidence, the study used Kolmogorov-Smirnov test. According to,19 in research article-“Risk in financial decisions and gender differences”, women seems to invest in less risky investment then the men. Most of the researches could not find the strong evidence for this claim but this article analyzed the gender differences in financial risk. In this research survey was conducted through the structured questionnaire. The techniques used to test the responses for gender differences in the financial risk aversion were univariate (frequencies and percentage) and bivariate (contingency tables, and test for mean differences); and correlation among variables was also examined. According to results of Christie P,20 study, in his selected six biases, Female are more inclined towards biases when compared to the male investors21 in their article-“Gender differences in investment preferences” explored the investment behavior of men and women in the emerging countries, like: Turkey. The aim of this study was to find out the investment preferences in men and women based on six investment tools i.e. gold, foreign currency, funds, common stocks, real estate and time deposit. In this research the discriminant analysis and logistics regression were used. The result shows that men investors were invest in the common stocks and real estate while the women investors invest in the fund , time deposits and gold , women are more risk averse than men in Turkey. There is no any significant relationship between men and women in the foreign currency investment22 argued in their article –“Gender differences in risk aversion” that the demographic variables of gender which has an impact on risk aversion based on gender differences as employment status, racial status, birth order. There is a common belief that women tend to have a stronger risk aversion than men, which is found from the real life observations and both men and women usually think that others are less risk tolerant, but for women it has been detected a strong stereotyped feeling as the results in this study exhibits that women seems to be more risk avoiding then men due to their lower level of wealth.

Sebai23 elaborated in their article- “Further evidence on Gender differences and their impact on risk aversion” that there is impact of gender on risk aversion in portfolio selection. The empirical study shows that the when the people have certain and much knowledge about finance and level of education has an adverse effect on risk aversion by gender. The descriptive analysis was done on socioeconomic variables such as knowledge, gender and income, which effect investment decisions. The result shows that the age factor has a positive impact on the probability of buying, the income is always insignificant and gender has also a positive impact on it. The research paper of24 Identity overconfidence and investment decision” analyzed that Men are more risk tolerant and have over confidence in the investment then the female. The author performed the 4 experiments to test whether social identity contributes to this heterogeneity. The subjects performed tasks to show their risk aversion and investment behavior. The identity is prescribed by the normative behaviors. The experiments were performed in the controlled environments, the results show that the male whose identity is primed or threatened becomes more risk tolerant then the non-primed and women. This identity changes put a higher impact on the money burning out investment opportunities. This study relates male identity to the overconfidence as it is induced to other subjects by priming their sense of power.

Hillesland M25 concluded that in various practical studies conducted at developed countries, female are often found to be more risk averse than male. Additionally, within the context of developing country the gender differences in risk attitudes may vary by cultural contexts. The study of Chen26 in “Gender differences in risk taking: Are women more risk averse” provides the theoretical background to draw a conclusion that women are more risk averse. His paper attempted to signify the gender differences of the risk taking in the financial markets. The systematic factors and individual characteristics were taken into account to elaborate the gender differences when choosing the risk levels. The women are more risk averse because they take more conservative decisions in the financial markets. The character traits are one of the dimensions of this study. The characteristics of the men of being competitive, optimistic, adventurous and overconfident than women make them to take more risk. However, a woman shows much pessimistic attitude toward ambiguity and pressure in financial markets then the men. Differences of the characteristics of the women and men make these variations in the risk taking levels.

Conceptual model

Based on the above literature, this study tests following conceptual model (Figure 1):

This research study is conclusive i.e. descriptive in the nature. The research is quantitative and based on deductive approach. A survey method was used to collect the data. Questionnaire consisting of 16 questions in two parts was distributed, in the various saving centers of Karachi, Hyderabad and Sukkur, to investors while they were coming to centers. It was too difficult to collect data because mostly investors were visiting the centers for entertaining their own queries. The instrument was designed by extracting and revamping the questions from book of Pompeian27 “Behavioral Finance and Wealth Management”.28 This research study collected the material from the primary as well as secondary sources. The primary method was „survey‟ in which the questionnaire was used to collect the data from the respondents. The secondary sources for the material were articles, research journals, books, and online websites. The Chi-square test is used to analyze gender differences towards behavioral factors (i.e. risk aversion and overconfidence). Moreover, the demographic variables is measured based on descriptive statistics (percentage and frequencies).29,30

H01: There is no significant association between gender and risk aversion.

H1: There is a significant association between gender and risk aversion.

H02: There is no significant association between gender and overconfidence.

H2: There is a significant association between gender and overconfidence.

The part one of the questionnaire consisting of demographics, viz, age, gender, investment experience and location of national saving center where they invested as shown in given table 1a. The highest response received from male (55%) with location of investment is Karachi (57%), whereas following this female response was recorded up-to 45% in investment centers of Karachi region. Sukkur region was ranked as last, reason may be awareness of investment as well as saving certificates/centers (Table 1): In order to minimize the complexity of different regions, the respondents were collectively investigated in hypotheses testing. Following eleven questions were included in part II of questionnaire (Part-I Demographics):

|

Age |

Gender M/F |

Avg. experience M/F |

Location |

|

|

> 20years 70 |

53/17 |

1-2 / 1-2 |

K=43 H= 18 S=09 |

|

|

21-40 years 181 |

102/79 |

5-6 / 4-5 |

K=104 H= 43 S=34 |

|

|

41-60 years 97 |

41/56 |

9-10 / 7-8 |

K= 55 H= 31 S=11 |

|

|

61-onwards 43 |

21/22 |

>10 / >10 |

K=19 H= 14 S=10 |

|

|

Total 391 |

217/174 |

K=221 H= 106 S=64 |

||

|

55%/45% |

K=57% H= 27% S= 16% |

|||

|

K= Karachi, |

H=Hyderabad |

S=Sukkur |

||

Table 1 the following shows that awareness of investment as well as saving certificates/centers

How would you describe yourself as a risk taker?

By asking this question, the individuals were asked that how they perceive themselves as the risk takers. The results from Table 2 show the propensity among male and female respondents to see themselves as risk takers. 41% the male answered that they are more careful about taking risk, whereas 55% of the female reported that they are more careful about taking risk. 17% of the male reported that they would be enthusiastic to take risks after carrying out adequate research, whereas only 6% of women showed the similar response. However, 17% of the male and 6% of the female showed that they see themselves as high risk takers. Lastly, 25% male and 33% female saw themselves directly as risk averse. The result shows that female are more risk averse than the male. The Chi square statistic for these responses is 8.850 and the significance value is 0.031 at 95% confidence interval that is lower than 0.05, which confirms that the gender differences for this question are significant. Hence, the responses in this question rejects the null hypothesis H01 (Figure 2).

How frequently do you invest?

Table 3 shows that the frequencies of the male and female show a difference in investment. 35% of the male respondents have answered that they sometimes invest any money in the financial market and for same questions 25% of the female respondents sometimes invest in financial market. 50% of the male respondents have never invested in financial market whereas 70% female have never invested in financial market it can be due to some constraints or might be due to lack of knowledge of the investors. Very less number of respondents as 15% male and 5% female respondents regularly invest in the financial markets. The Chi square statistic is 1.150 and the significance value is 0.563 at 95% confidence interval which is higher than 0.05, which confirms that even though the female invest less in the financial markets (may be to avoid the risk) the gender differences for this question are insignificant. Hence, the null hypothesis H01 is accepted and this shows that frequency of investment has no significant association with gender (Figure 3).

|

Chi-Square Tests |

|||

|

Value |

df |

Asymp. Sig. (2-sided) |

|

|

Pearson Chi-Square |

8.850a |

3 |

0.031 |

|

Likelihood Ratio |

9.076 |

3 |

0.028 |

|

Linear-by-Linear Association |

8.69 |

1 |

0.003 |

|

N of Valid Cases |

140 |

||

|

a. 0 cells (.0%) have expected count less than 5. The minimum expected count is 7.00. |

|||

Table 2 Risk Taker Status

|

Chi-Square Tests |

|||

|

Value |

df |

Asymp. Sig. (2-sided) |

|

|

Pearson Chi-Square |

1.150a |

2 |

0.563 |

|

Likelihood Ratio |

1.152 |

2 |

0.562 |

|

Linear-by-Linear Association |

0.988 |

1 |

0.32 |

|

N of Valid Cases |

140 |

||

|

a. 0 cells (.0%) have expected count less than 5. The minimum expected count is 5.50. |

|||

Table 3 Frequently Investment Status

You have received 100,000 rupees with one condition; you have to invest the money in one of the following alternatives. Which one would you choose?

The results in Table 4 show that the individuals are more interested to invest in a saving account of bank if they have 100,000 rupees. 18% of the male respondents and 32% of the female respondents are willing to save money in saving accounts. 25% male respondents chose the option to invest in mutual funds and 32% female have chosen to invest in 10 different mutual funds. 25% of the male participants and 18% female participants have chosen to invest in the stock market. In the government bonds male and female investors have 32% and 18% respectively in bond investments. This shows that female somewhat are more inclined to invest in safer instruments and avoid the risk (Figure 4). The Chi square statistic is 5.753 and the significance value is 0.124 at 95% confidence interval which is higher than 0.05, which confirms that the gender differences for this question are less significant. Hence, the null hypothesis H01 is not rejected.

|

Chi-Square Tests |

|||

|

Value |

df |

Asymp. Sig. (2-sided) |

|

|

Pearson Chi-Square |

5.753a |

3 |

0.124 |

|

Likelihood Ratio |

5.837 |

3 |

0.12 |

|

Linear-by-Linear Association |

0.903 |

1 |

0.342 |

|

N of Valid Cases |

140 |

||

|

a. 0 cells (.0%) have expected count less than 5. The minimum expected count is 9.50. |

|||

Table 4 Alternative Choice

How do you consider your skills at planning your personal economy?

Table 5 shows that only a small number of the respondents has given the answer as considering their skills “bad” while planning the personal economy, among those 26% were the female respondents and 42% were the male respondents. Moreover, the high distribution was found as the 33% male and 57% female consider themselves as good in skills of planning the personal economy. 25% of the male investors as compared to the 17% of the female investors predicted their skills as excellent. These results show the mixed outcomes as some male as well as some female appear to be overconfident (Figure 5).

|

Chi Square Test |

|||

|

Value |

df |

Asymp. Sig. (2-sided) |

|

|

Pearson Chi-Square |

1.531a |

2 |

0.465 |

|

Likelihood Ratio |

1.541 |

2 |

0.463 |

|

Linear-by-Linear Association |

0.519 |

1 |

0.471 |

|

N of Valid Cases |

140 |

||

|

a. 2 cells (33.3%) have expected count less than 5. The minimum expected count is 4.50. |

|||

Table 5 Planning for Personal Economy

The chi square-test table shows that there is significant difference of the response of the genders at 95% confidence level. The Chi square statistic is 1.531 and the significance value is 0.465 at 95% confidence interval which is higher than 0.05, which confirms that the gender differences for this question are not significant. Hence, the null hypothesis H02 is not rejected and shows that there is no significant association between gender and overconfidence.

Assume you are given 10,000 rupees and the chance to earn additional money, which one of the following alternative would you choose?

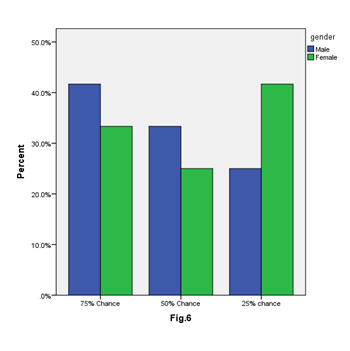

Table 6 shows that 40% of the female have responded to take the 50% chance for getting the double of their investment or zero, while 27% of the male were also at the moderate risk level. For the 2nd alternative the results found that higher proportion of the male was 40% and female proportion was lower with 27% at taking the 25% chance. Same percentages of male and female showed that they will choose the 3rd alternative indicating the highest risk. These results indicate that the female are risk averse as compared to the male. The Chi square statistic is 6.717 and the significance value is 0.035 at 95% confidence interval which is lower than 0.05, which confirms that the gender differences for this question are significant. Hence, the null hypothesis H01 is rejected proposing that there is significant association between gender and the risk aversion (Figure 6).

|

Chi-Square Tests |

|||

|

Value |

df |

Asymp. Sig. (2-sided) |

|

|

Pearson Chi-Square |

6.717a |

2 |

0.035 |

|

Likelihood Ratio |

6.777 |

2 |

0.034 |

|

Linear-by-Linear Association |

4.265 |

1 |

0.039 |

|

N of Valid Cases |

140 |

||

|

a. 0 cells (.0%) have expected count less than 5. The minimum expected count is 6.50. |

|||

Table 6 Choosing Investment alternatives with additional money

You are given 20,000 rupees with a condition that you have to gamble, which of the following alternative would you choose?

The results from Table 7 show that 43% of the male investors were willing to take the chance in the high risk level in comparison with the 33% of the female. However, 33% male have shown the higher proportion in moderate risk level than 24% of the female. In the lower level of the risk the 43% of female have shown the higher proportion of avoiding the risk than the 24% of male in the same alternative. This shows that the female are more inclined towards risk aversion as compared to the male (Figure 7). The Chi square statistic is 1.861 and the significance value is 0.394 at 95% confidence interval which is higher than 0.05, which confirms that the gender differences for this question are insignificant. Hence, the null hypothesis H01 is not rejected.

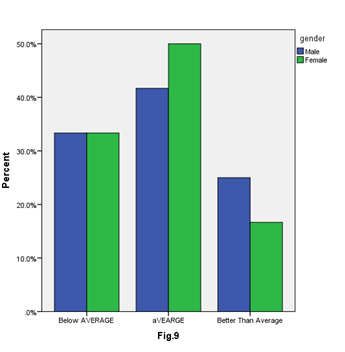

How will you consider your performance if you invest in any stock exchange?

The results from Table 8 show that how the respondents will consider their performance if they invest in any stock exchange so, in the below average choice female were 50% and male were 34%. While in the about average male were 50% and female were 42%, it means that male consider more about average their performance while investing. In above average option, male were 16% and female were only 8%, so it shows that the male consider their performance above average if they will invest in the stock exchange than female. These outcomes clear this point that before even investing in the stock exchange the male predict that their performance will be average or above average and in comparison to this more female have reported that they see their performance as below average which shows that the female are less confident in their abilities than the male (Figure 8). The chi square value for this question is 2.518 while the significance value at 95% confidence interval is 0.284 which is above 0.05, this shows that gender differences in this question are not significant. Hence, the null hypothesis H02 is accepted.

|

Chi-Square Tests |

|||

|

Value |

df |

Asymp. Sig. (2-sided) |

|

|

Pearson Chi-Square |

1.861a |

2 |

0.394 |

|

Likelihood Ratio |

1.877 |

2 |

0.391 |

|

Linear-by-Linear Association |

0.84 |

1 |

0.36 |

|

N of Valid Cases |

140 |

||

|

a. 0 cells (.0%) have expected count less than 5. The minimum expected count is 12.00. |

|||

Table 7 Gambling Status with choice among different alternatives

Figure 7 Differences of the characteristics of the women and men make these variations in the risk taking levels.

Imagine that you just lost 1,000 rupees in a game and had to choose one of the following alternatives, which one would you choose?

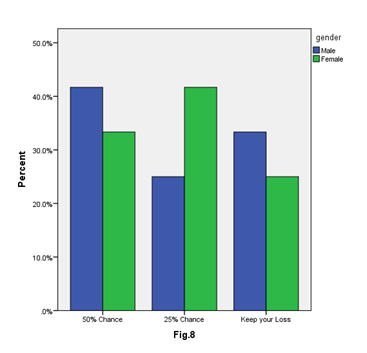

In this question, the respondents were Table 9 confronted with a situation that they have lost 1000 rupees then which alternative will they choose among the given options. As per Table 4.8, 42% of the male while 31% of the female chose the alternative 1 which is less risky. 27% of the male and 42% of the female chose the 2nd alternative which shows the moderate risk. While 31% of the male and 27% of the female reported that they will keep their loss without further action. This shows that when it comes to losing money the female are more willing to take further action to recover the amount as compared to the male. The chi square value for this question is 2.904 while the critical value at 95% confidence interval is 0.234 which is above 0.05, this shows that gender differences in this question are not significant. Hence, the null hypothesis H01 is accepted (Figure 9).

|

Chi-Square Tests |

|||

|

Value |

Df |

Asymp. Sig. (2-sided) |

|

|

Pearson Chi-Square |

2.518a |

2 |

0.284 |

|

Likelihood Ratio |

2.539 |

2 |

0.281 |

|

Linear-by-Linear Association |

2.372 |

1 |

0.124 |

|

N of Valid Cases |

140 |

||

|

a. 0 cells (.0%) have expected count less than 5. The minimum expected count is 11.00. |

|||

Table 8 Performance of Investment in Stock Exchange

|

Chi-Square Tests |

||||

|

Value |

df |

Asymp. Sig. (2-sided) |

||

|

Pearson Chi-Square |

2.904a |

2 |

0.234 |

|

|

Likelihood Ratio |

2.921 |

2 |

0.232 |

|

|

Linear-by-Linear Association |

0.012 |

1 |

0.914 |

|

|

N of Valid Cases |

140 |

|||

|

a. 0 cells (.0%) have expected count less than 5. The minimum expected count is 14.50. |

||||

Table 9 Loosing Status

Figure 9 The null hypothesis H01 is accepted and this shows that frequency of investment has no significant association with gender.

How do you consider your ability to come along with other people?

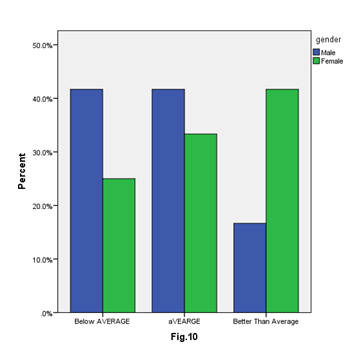

Table 10 shows that how the respondents consider their ability to come along with other people. Same 33% of the male and female considered their ability as below average which means that there is no difference between male and female regarding considering their ability. In about average option male were 42% and female were 49% which interprets that more female consider their ability to come along with other people to be average. Now in the third condition above average male were 25% and female were 18%. This shows the mixed results. The chi square value for this question is 0.521 while the significance value at 95% confidence interval is 0.771 which is above 0.05, this

shows that gender differences in this question are not significant. Hence, the null hypothesis H02 is accepted (Figure 10).

|

Chi-Square Tests |

|||

|

Value |

df |

Asymp. Sig. (2-sided) |

|

|

Pearson Chi-Square |

.521a |

2 |

0.771 |

|

Likelihood Ratio |

0.521 |

2 |

0.771 |

|

Linear-by-Linear Association |

0.071 |

1 |

0.79 |

|

N of Valid Cases |

140 |

||

|

a. 0 cells (.0%) have expected count less than 5. The minimum expected count is 12.50. |

|||

Table 10 Ability of Decision Making Status

Figure 10 Shows that only a small number of the respondents has given the answer as considering their skills “bad” while planning the personal economy.

How good are you at speaking English compared to other colleagues at your institute?

By asking about the English language proficiency by the respondents, this question actually measures their overconfidence. According to Table 11, out of the total respondents, 42% male and 25% female respondents replied that they consider themselves below average in speaking English language as compared to other colleagues at their institute. 42% male respondents while 33% female respondents reported themselves as average in speaking English. While the remaining 16% of the male respondents and 42% of the female respondents showed that they consider their proficiency of English speaking as better than average. These responses indicate that female have more confidence on their English language proficiency as compared to the male investors taken for this study. The chi square value for this question is 4.152 while the critical value at 95% confidence interval is 0.125 which is above 0.05, this shows that gender differences in this question are not significant. Hence, the null hypothesis H02 is accepted (Figure 11).

|

Chi-Square Tests |

|||

|

Value |

df |

Asymp. Sig. (2-sided) |

|

|

Pearson Chi-Square |

4.152a |

2 |

0.125 |

|

Likelihood Ratio |

4.203 |

2 |

0.122 |

|

Linear-by-Linear Association |

4.117 |

1 |

0.042 |

|

N of Valid Cases |

140 |

||

|

a. 0 cells (.0%) have expected count less than 5. The minimum expected count is 9.00. |

|||

Table 11 Speaking in English Status

Figure 11 Shows that 40% of the female have responded to take the 50% chance for getting the double of their investment or zero, while 27% of the male were also at the moderate risk level.

You have inherited 250,000 rupees with a condition to invest in one of the following alternatives, which option would you choose?

This question basically measures the tendency of the respondents to take the higher level of risk. Table 12 shows that 34% male and 42% female investors chose the alternative 1 which was more inclined towards risk aversion, while 42% male and 34% female replied that they will choose the 2nd alternative which is based on the moderate risk, however only 24% male and 24% of female chosen the 3rd alternative indicating the higher level of risk. These responses indicate the mixed results as in alternative 3 but in alternative 1 the percentage of female as compared to male is high. The chi square value for the question is 1.053 while the critical value at 95% confidence interval is 0.591 which is greater than 0.05 showing that the gender differences for this question are not significant hence, accepting the null hypothesis H01(Figure 12).

|

Chi-Square Tests |

|||

|

Value |

df |

Asymp. Sig. (2-sided) |

|

|

Pearson Chi-Square |

1.053a |

2 |

0.591 |

|

Likelihood Ratio |

1.055 |

2 |

0.59 |

|

Linear-by-Linear Association |

0.062 |

1 |

0.803 |

|

N of Valid Cases |

140 |

||

|

a. 0 cells (.0%) have expected count less than 5. The minimum expected count is 9.00. |

|||

Table 12 Choosing among Alternatives for Investment the Inheritance Amount

Findings

Major findings:

|

Table of Summary of acceptance and rejection of the Hypotheses |

|||

|

H01: There is no significant association between gender and risk aversion. |

H02: There is no significant association between gender and overconfidence. |

||

|

How would you describe yourself as a risk taker? |

How do you consider your skills at planning your personal economy? |

||

|

Rejected |

Accepted |

||

|

How frequently do you invest? Accepted |

How will you consider your performance if you invest in any stock exchange? |

||

|

Accepted |

|||

|

You have received 100,000 rupees with one condition; you have to invest the money in one of the following alternatives. Which one would you choose? Accepted |

How do you consider your ability to come along with other people? Accepted |

||

Table 13 the null hypothesis H02 is accepted

After general observation we have concluded that gender has an effect on financial decisions. In this study we found that male (of all regions: Karachi, Hyderabad & Sukkur) approach is less conservative and traditional in financial decision as compare to female and according to the risk aversion survey shows that male are more risk takers than female. It has been observed in above statement that the preference of male is more in investing in more risky opportunities when compared to female, whereas female prefer to invest in risk free or less risky investment. Beside the gender differences, there are fewer investors who prefer to invest in the financial market due to lack of knowledge and lack of interest. The main purpose of the study was to conclude that if gender actually effect on the financial decision particularly among well-educated set of individuals as it raised the concept of equality. We desired to see relationship among gender, risk aversion and overconfidence biases. After interpretation of results it shows that male is more risk taker than female and there is a behavioral bias on investment decision making while male also tend to invest more frequently. We cannot reach to any conclusion on the basis of overconfidence because research study has shown the mixed results due to some limitations and we were not able to determine that either male is overconfident or female. There is no specific significant pattern of overconfidence in the results as male seem to be more overconfident in investment decision making but still no significant association was found. In a nutshell, both the null hypotheses of this study were accepted. In our study it shows that the associations of these biases with the gender were not found to be significant on the gender differences‟ in the risk aversion and overconfidence in the decision making.

In this research study there is no statistically significant difference found on the basis of male and female. Though the results are somewhat mixed when considering the risk aversion and over confidence levels. The overconfidence level was not that much found to be inclined towards the male as the literature suggested. However, the women seems to be the more risk averse then the men in most of the questions then the male. The variations in the results may be due to certain factors as found in the study of there was no much differences found in between the male and female in the predictions. The level of the over confidence is expressed sometimes to avoid the under confidence about the judgments. The level of the overconfidence depends upon the time and situation; and the judgment of the event is based upon that situation. Individuals may found to be having different levels of the overconfidence in the different tasks. As it is not only the gender difference which may have influence on it, the self-esteem of the individuals have found to influence the over confidence level. Considering the risk aversion the women tends to be risk averse but the difference was not significantly difference. As found in the study of there was the difference in the sample as some professors and researchers have much knowledge of the financial economics and others had very limited knowledge. The women found to be more risk loving in the departments other than the finance, means they have not much knowledge of the finance. This was in contrast with the men who were risk loving the departments with the financial literacy then the departments other than financial literacy. Respectively the sample chosen for the current study was the investors who have at least studied one course of the finance. This can be the leading factor for the insignificance as the investors though have attended any finance course but the extent and the level of the financial knowledge may varies between the investors and may not show the significant level of differences between the male and female investors‟ responses.

This study provided an insight about “Gender differences in overconfidence & risk aversion in investment decision making”. Nevertheless, due to the limitations of the study further future researches on the topic are needed. Furthermore, other behavioral biases that may have any implication regarding the gender differences are also suggested to be pondered over. Such future researches can further unleash the behavioral biases that are influenced by the gender differences and can enhance the literature in the field of behavioral finance. Moreover the current study also suggests to use some more effective tools and other instruments in future must be used to measure the gender differences in risk aversion in decision making and overconfidence in a more sophisticated and precise manner. (Iyer) elaborated that male are often vulnerable to some biases like: overconfidence, Myopia, Pride/regret, House money effect etc. while on the other hand the female are more vulnerable to the biases like: risk aversion, Snake bite effect, representative and availability bias. Hence, this study will suggest future researches on such biases while considering the role of gender differences.

None.

The author declares there is no conflict of interest.

None.

©2019 Shaikh, et al. This is an open access article distributed under the terms of the, which permits unrestricted use, distribution, and build upon your work non-commercially.